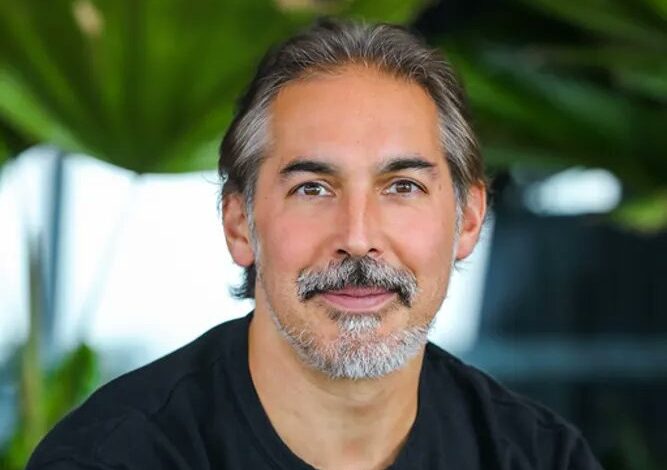

Suneil Setiya: The Private Billionaire Behind Quadrature, Climate Philanthropy, and Quiet Power

In the rarefied world of quantitative hedge funds, few figures are as influential yet as private as Suneil Setiya. Known primarily as the co-founder of Quadrature, Setiya has built a reputation for scientific rigour, long-term thinking, and an unusually low public profile for a man whose wealth is estimated in the billions. Beyond finance, he is also a major climate philanthropist and a figure of growing public interest due to political donations and ethical debates surrounding modern investment practices.

Suneil Setiya Age

Suneil Setiya was born in May 1973, making Suneil Setiya’s age 52 as of 2026. He is British by nationality and was educated at Hymers College, an independent school in England known for strong academic outcomes.

He later attended Worcester College, University of Oxford, where he studied Physics. This scientific background would become a defining feature of his professional life, shaping his approach to markets, data, and risk. Unlike traditional financiers, Setiya entered finance with a physicist’s mindset: hypothesis-driven, analytical, and deeply focused on systems rather than short-term narratives.

Suneil Setiya Quadrature: Building a Quantitative Powerhouse

Founding of Quadrature

In 2010, Suneil Setiya co-founded Quadrature, a London-based quantitative hedge fund, alongside Greg Skinner. Quadrature was built on the principle that markets could be analysed and traded using advanced mathematics, data science, and automation rather than human intuition.

From its earliest days, Quadrature adopted a deliberately low-profile strategy. The firm avoided marketing itself aggressively and instead focused on performance, research, and talent. Over time, this approach proved extraordinarily successful.

How Quadrature Operates

Quadrature is best known for its algorithmic and market-neutral trading strategies. These strategies typically involve:

-

High-frequency and systematic trading

-

Rapid portfolio turnover

-

Exposure across equities, commodities, and derivatives

-

Minimal reliance on discretionary decision-making

Because of this structure, Quadrature’s holdings can change quickly. This point has become important in public debates, as snapshots of investments are sometimes mistaken for long-term positions or ideological commitments.

Greg Skinner and Suneil Setiya: A Long-Term Partnership

Who Is Greg Skinner?

The partnership between Greg Skinner and Suneil Setiya is one of the most enduring and discreet in modern finance. Greg Skinner, a technologist and financier, shares Setiya’s preference for privacy and analytical thinking.

Together, they have:

-

Co-founded Quadrature

-

Overseen its growth into one of Europe’s most successful hedge funds

-

Co-established major philanthropic initiatives

How Their Partnership Works

While neither partner speaks publicly about internal roles in detail, the relationship is widely understood to be complementary. Setiya’s physics background and Skinner’s technological expertise helped shape Quadrature into a firm where research and systems dominate over personalities.

Importantly, Greg Skinner and Suneil Setiya are not related by family. Their connection is purely professional, built over years of collaboration and shared values.

Suneil Setiya Net Worth: How Wealth Was Built

Estimated Wealth

Although exact figures are not disclosed, Suneil Setiya’s net worth is widely estimated to be between £900 million and £1.1 billion, placing him firmly among the wealthiest financiers in the United Kingdom.

His wealth is primarily derived from:

-

Ownership stakes in Quadrature

-

Long-term fund performance

-

Profit-sharing and equity structures rather than conventional salaries

Unlike many hedge fund founders, Setiya is not known for conspicuous consumption or public displays of wealth.

A Different Approach to Money

What distinguishes Suneil Setiya from many peers is how much of his wealth has been channelled into philanthropy. Rather than creating a personal foundation centred on legacy branding, he has focused on systemic issues, particularly climate change.

Quadrature Climate Foundation and Climate Philanthropy

In 2019, Setiya and Skinner helped establish the Quadrature Climate Foundation. The foundation has since committed over one billion US dollars to climate-related causes, including:

-

Climate science research

-

Emissions reduction strategies

-

Climate resilience in vulnerable regions

-

Policy-relevant scientific modelling

Setiya serves as a trustee and director, reinforcing that his role is not symbolic but deeply involved in governance and strategy.

Suneil Setiya Wife, Wedding, and Personal Life

There is no publicly confirmed information about Suneil Setiya’s wife, marriage, or wedding.

A Deliberately Private Individual

Unlike many high-net-worth individuals, Setiya has successfully kept his personal life out of the public domain. There are:

-

No verified interviews discussing a spouse

-

No public wedding records

-

No social media presence confirming family details

This level of privacy is intentional and consistent with his broader approach to life and business.

Political Attention and Public Scrutiny

Why His Name Appears in the News

In recent years, Suneil Setiya’s name has appeared more frequently in public discourse due to:

-

Large political donations linked to Quadrature

-

Questions about hedge fund ethics

-

Debates around fossil fuel exposure versus climate philanthropy

These discussions highlight a broader tension in modern finance: how algorithmic investment firms interact with politics, public policy, and social responsibility.

Quadrature’s Position

Quadrature has consistently stated that its trading activity is automated and non-ideological, and that philanthropic activities are conducted independently through formal governance structures.

Suneil Setiya Wikipedia

The absence of a detailed Wikipedia-style public profile is not accidental. Setiya has avoided:

-

Personal branding

-

Media interviews

-

Conference speaking circuits

As a result, much of what is known comes from regulatory records, institutional disclosures, and reputable reporting rather than self-promotion.

Legacy and Influence

A New Model of Power

Suneil Setiya represents a modern form of influence:

-

Enormous financial impact

-

Minimal public exposure

-

Long-term philanthropic thinking

-

Science-led decision-making

His career challenges traditional assumptions that power must be loud or visible.

What the Future May Hold

As climate change, political funding, and financial transparency continue to dominate public debate, Setiya’s role may attract further attention. Whether he chooses to remain entirely private or engage more openly remains to be seen.

Quick Info

| Field | Details |

|---|---|

| Full Name | Suneil Setiya |

| Date of Birth | May 1973 |

| Age | 52 years (as of 2026) |

| Nationality | British |

| Profession | Hedge Fund Founder, Financier, Philanthropist |

| Education | BA in Physics, Worcester College, University of Oxford |

| Schooling | Hymers College, England |

| Known For | Co-founding Quadrature (quantitative hedge fund) |

| Company | Quadrature |

| Founded Quadrature | 2010 |

| Co-Founder | Greg Skinner |

| Current Role | Owner & Director at Quadrature |

| Philanthropy | Trustee & Director, Quadrature Climate Foundation |

| Net Worth (Estimated) | £900 million – £1.1 billion |

| Marital Status | Not publicly disclosed |

| Wife / Wedding | No confirmed public information |

| Residence | London, United Kingdom |

| Public Profile | Extremely private, low media presence |

| Wikipedia Page | No official standalone page (information from public records & reports) |

Final Thoughts

Suneil Setiya is not a celebrity financier, nor does he seek recognition. Yet his influence spans global markets, climate policy, and political debate. At 52 years old, with an estimated net worth exceeding £1 billion, he stands as one of the most consequential yet least understood figures in British finance.

From Suneil Setiya Quadrature to Greg Skinner and Suneil Setiya’s partnership, from climate philanthropy to personal privacy, his story is a reminder that some of the most powerful individuals operate quietly, shaping the world without seeking the spotlight.

FAQs

1. What is Suneil Setiya known for?

Suneil Setiya is best known as the co-founder of Quadrature, a London-based quantitative hedge fund, and as a trustee of the Quadrature Climate Foundation, one of the world’s largest climate-focused philanthropic organisations.

2. How old is Suneil Setiya?

Suneil Setiya was born in May 1973, which makes him 52 years old as of 2026.

3. What is Suneil Setiya’s net worth?

Suneil Setiya’s net worth is estimated to be between £900 million and £1.1 billion, primarily derived from his ownership stake in Quadrature and the firm’s long-term investment performance.

4. Is Suneil Setiya married?

There is no publicly confirmed information about Suneil Setiya’s wife, wedding, or marital status. He keeps his personal and family life extremely private.

5. What is the relationship between Greg Skinner and Suneil Setiya?

Greg Skinner and Suneil Setiya are long-term business partners and co-founders of Quadrature. They are not related by family but have worked closely together since 2010 in finance and philanthropy.